Getting The Personal Loans Canada To Work

Getting The Personal Loans Canada To Work

Blog Article

A Biased View of Personal Loans Canada

Table of ContentsPersonal Loans Canada Can Be Fun For EveryonePersonal Loans Canada Things To Know Before You Get ThisThe Greatest Guide To Personal Loans CanadaPersonal Loans Canada for BeginnersSome Known Facts About Personal Loans Canada.

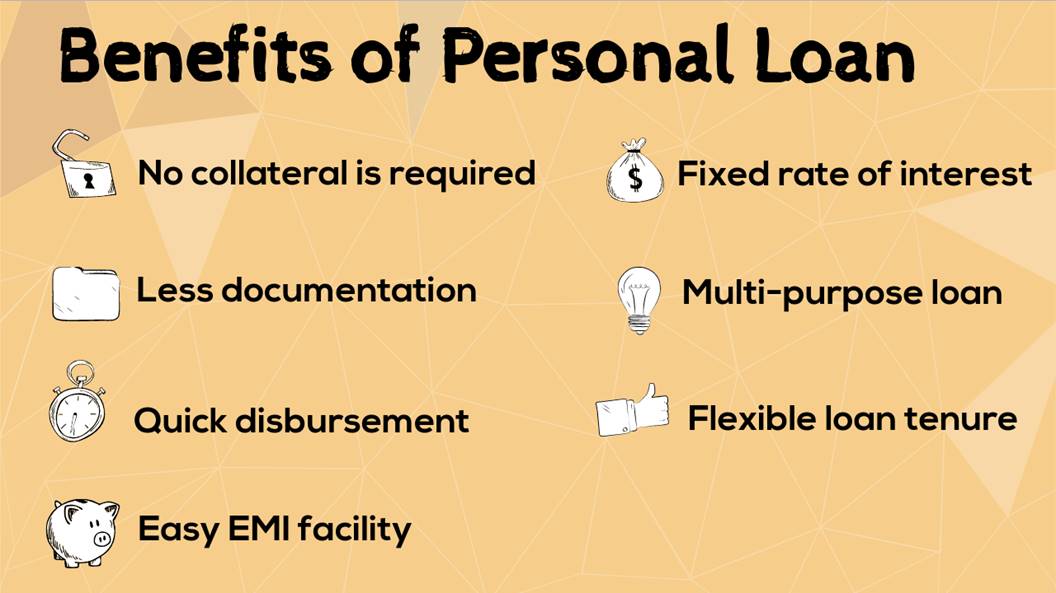

Payment terms at the majority of individual loan lending institutions vary between one and seven years. You get all of the funds at when and can utilize them for virtually any objective. Customers often utilize them to finance a property, such as an automobile or a boat, repay financial debt or help cover the expense of a significant expenditure, like a wedding event or a home remodelling.

A set rate gives you the safety and security of a predictable regular monthly settlement, making it a preferred choice for combining variable price credit score cards. Repayment timelines differ for individual finances, but customers are often able to choose repayment terms between one and seven years.

The Ultimate Guide To Personal Loans Canada

You might pay a first source fee of as much as 10 percent for an individual funding. The charge is generally subtracted from your funds when you complete your application, reducing the quantity of cash money you pocket. Personal financings prices are much more straight connected to short-term prices like the prime price.

You might be used a lower APR for a shorter term, because lending institutions know your balance will certainly be settled much faster. They may bill a greater price for longer terms knowing the longer you have a lending, the more probable something can change in your financial resources that might make the settlement expensive.

A personal car loan is additionally an excellent choice to making use of charge card, because you borrow money at a fixed rate with a precise benefit day based on the term you choose. Keep in mind: When the honeymoon is over, the regular monthly repayments will additional reading certainly be a pointer of the cash you spent.

Personal Loans Canada Can Be Fun For Anyone

Before handling financial obligation, make use of a personal loan payment calculator to help spending plan. Gathering quotes from multiple lending institutions can aid you detect the most effective offer and potentially conserve you interest. Compare passion prices, charges and loan provider credibility before requesting the financing. Your credit report rating is a big consider determining your eligibility for the loan in addition to the rate of interest.

Before using, know what your rating is to ensure that you recognize what to expect in terms of costs. Be on the lookout for covert charges and penalties by reviewing the lending institution's terms and conditions page so you don't finish up with less cash than you require for your monetary goals.

They're much easier to certify for than home equity financings or other protected car loans, you still need to show the loan provider you have the ways to pay the funding back. Individual lendings are far better than credit report cards if you desire an established month-to-month repayment and need all of your funds at as soon as.

Little Known Questions About Personal Loans Canada.

Credit scores cards may be much better if you need the versatility to draw cash as required, pay it off and re-use it. Charge card might additionally provide rewards or cash-back alternatives that individual financings don't. Ultimately, the most effective credit scores item for you will rely on your cash behaviors and what you require the funds for.

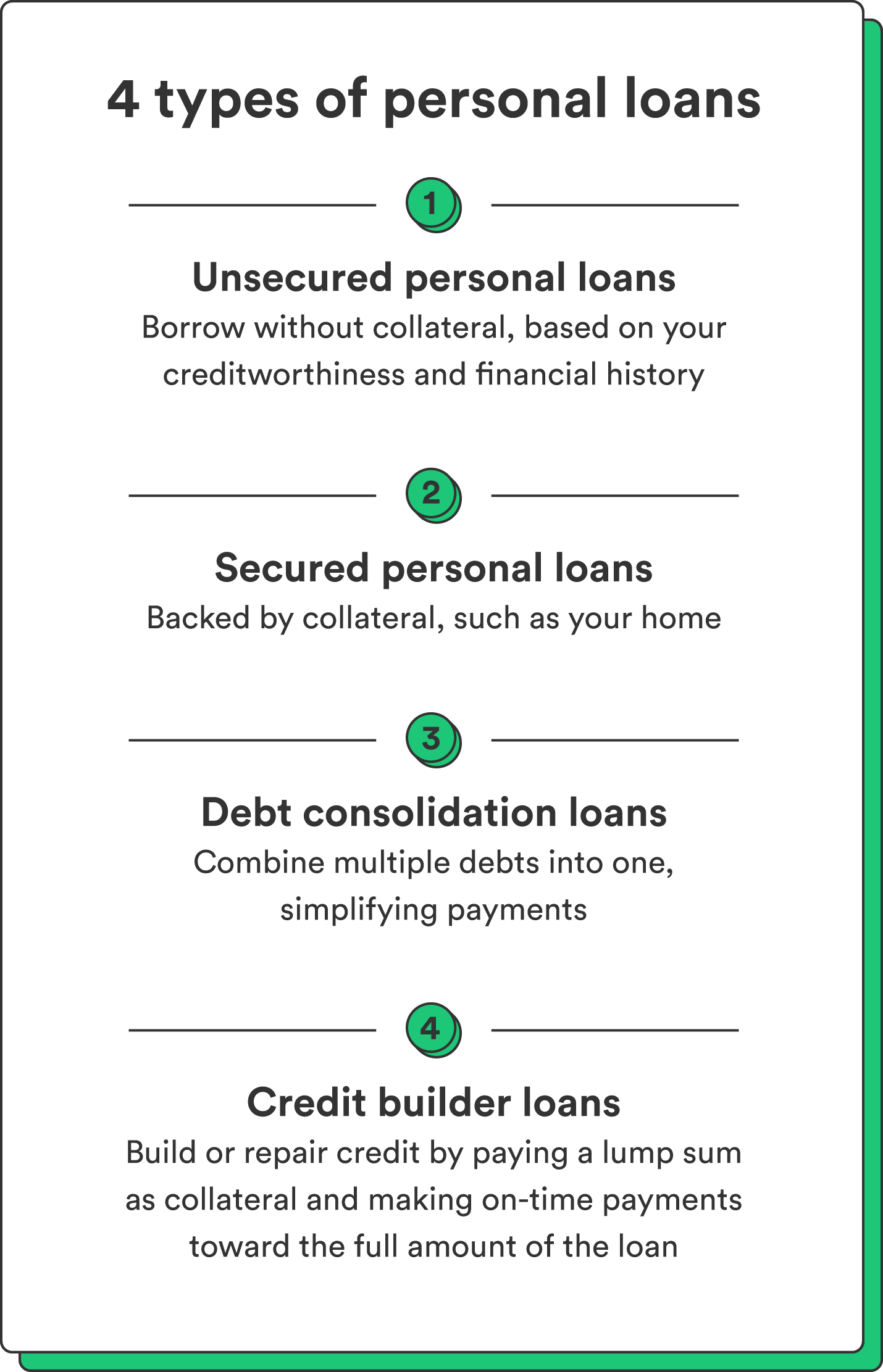

Some loan providers may likewise charge fees for individual lendings. Individual click here to read car loans are fundings that can cover a variety of personal expenses. You can discover personal fundings with banks, cooperative credit union, and online loan providers. Individual financings can be protected, meaning you require collateral to borrow cash, or unsafe, without any security required.

, there's generally a fixed end date by which the funding will certainly be paid off. An individual line of credit report, on the various other hand, might remain open and readily available to you forever as lengthy as your account stays in excellent standing with your lender.

The cash obtained on the lending is not exhausted. If the lending institution forgives the finance, it is thought about a canceled financial obligation, and that amount can be exhausted. A protected personal loan requires some type of collateral as a condition of borrowing.

Facts About Personal Loans Canada Revealed

An unsecured individual loan calls for no collateral to borrow cash. Banks, credit unions, and online loan providers can offer both safeguarded and unsafe individual loans to certified consumers. Banks normally consider the last to be riskier than the former since there's no security to collect. That can suggest paying a higher rate of interest for an individual loan.

Again, this can be a financial institution, credit score union, or on the internet personal car loan lending institution. Typically, you would initially complete an application. The lending institution advice assesses it and decides whether to accept or refute it. If approved, you'll be given the financing terms, which you can accept or reject. If you consent to them, the next action is completing your financing paperwork.

Report this page